In the United States, hiring an employee comes with the serious financial responsibility of providing worker’s compensation in the event of a work-related injury or health complication. Unfortunately, there is no fixed rate that all U.S. business owners are required to pay for this coverage. Instead, worker’s compensation premiums are determined by regional factors such as medical costs, number of fraudulent claims per year, and litigation fees.

In California, worker’s compensation costs are among the top five most expensive nationwide. It is for this reason that Samuel Hale is committed to helping employers save money on premiums and avoid falling victim to fraudulent claims.

To ensure the best possible rate, it is important to understand the various elements that affect worker’s compensation costs in California.

Why California Workers Compensation Costs Are So High?

Below we have broken down a few of the most influential factors and how they are driving up costs for business owners. Also read: how to reduce workers’ compensation costs?

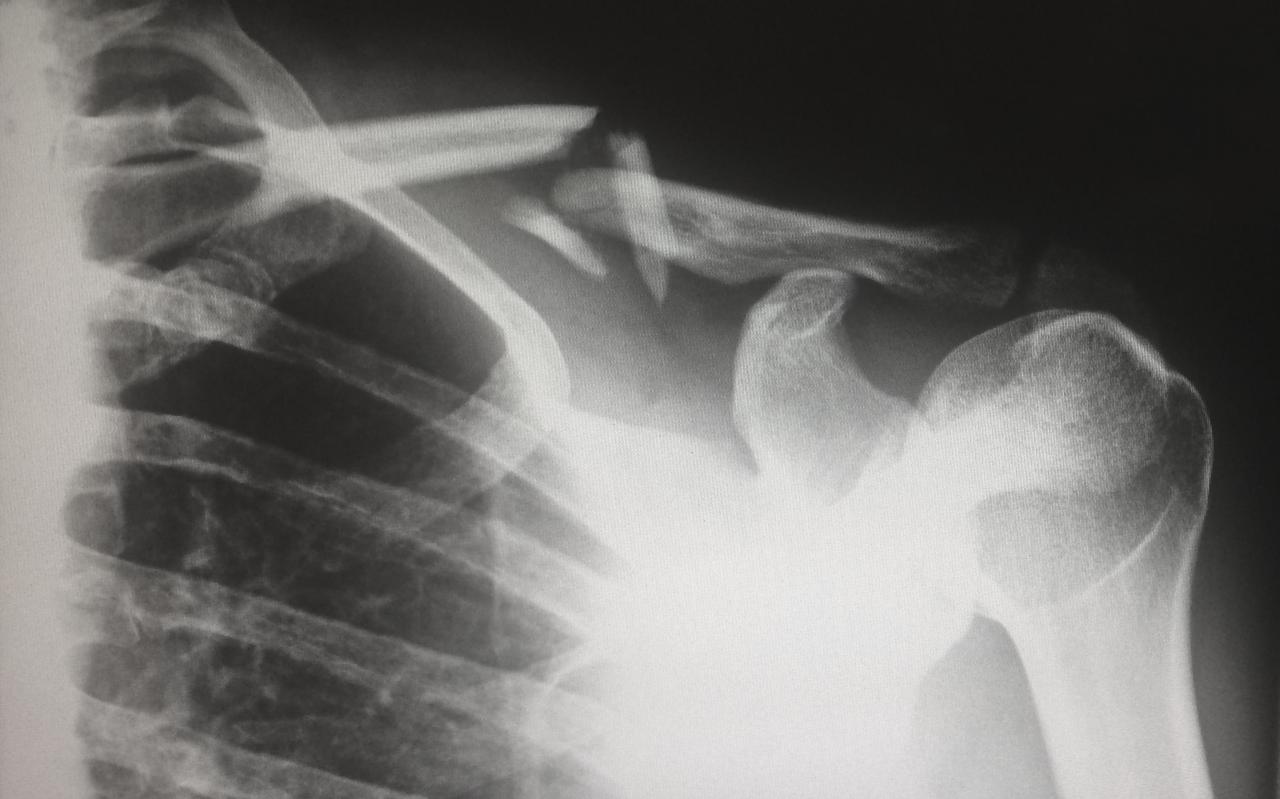

Permanent disability

In California, employees file for permanent disability far more frequently than in other states. Sufferers of work-related injuries can obtain a percentage of their salary for up to one year following an accident. Unfortunately, many individuals exploit these benefits by intentionally extending medical treatments beyond the necessary duration. While the total percentage of the population receiving permanent disability benefits is far less than in other states, the current amount of money paid out in benefits thus far has reached a staggering $923 million. This figure is over 300% higher than the second most affected state by permanent disability claims. It is no surprise then, that business owners are required to pay a higher premium in the state of California.

Medical expenses

In Northern California, the healthcare market is highly concentrated, which has steadily driven the cost of healthcare services up over the past several decades. Similarly, the cost of prescription drugs in California is rising by over 5% every year. This is due to an increase in the use of pharmaceutical drugs combined with manufacturers constantly raising the price of medicine. As a result, employees seeking treatment for work-related health problems must have access to more funds paid by their employer.

Legal fees

In order to file a claim for worker’s compensation, employees must hire an attorney who specializes in personal injuries. These fees however, are some of the main culprits of the high worker’s compensation premium paid by California employers. The average cost of lawyer fees in California is among the top ten most expensive in the United States with a high rate of approximately $420. Accident lawyers may take up to 50% of the funds raised in a personal injury case. To account for California’s high cost of litigation, employers must be insured with a more expensive worker’s compensation plan than required in other states.

Fraud

There are several ways that an employee may commit worker’s compensation fraud. In California, there have been many cases where workers have submitted false claims, provided false medical documentation, or denied ever having received their benefits. Furthermore, there have been various incidents of organized worker’s compensation fraud that involve the conspiring of employees, healthcare professionals, and personal injury lawyers. In the state of California, accident victims are not required to prove that their injury occurred due to the negligence of their employer. This makes worker’s compensation fraud a far more common problem than in other states. Employers must therefore, pay a higher premium to account for this elevated number of claims per year.

Protect your organization against excess worker’s compensation fees with the help of Samuel Hale. Reach out today to find out how we can help you cut costs by paying a reduced premium.