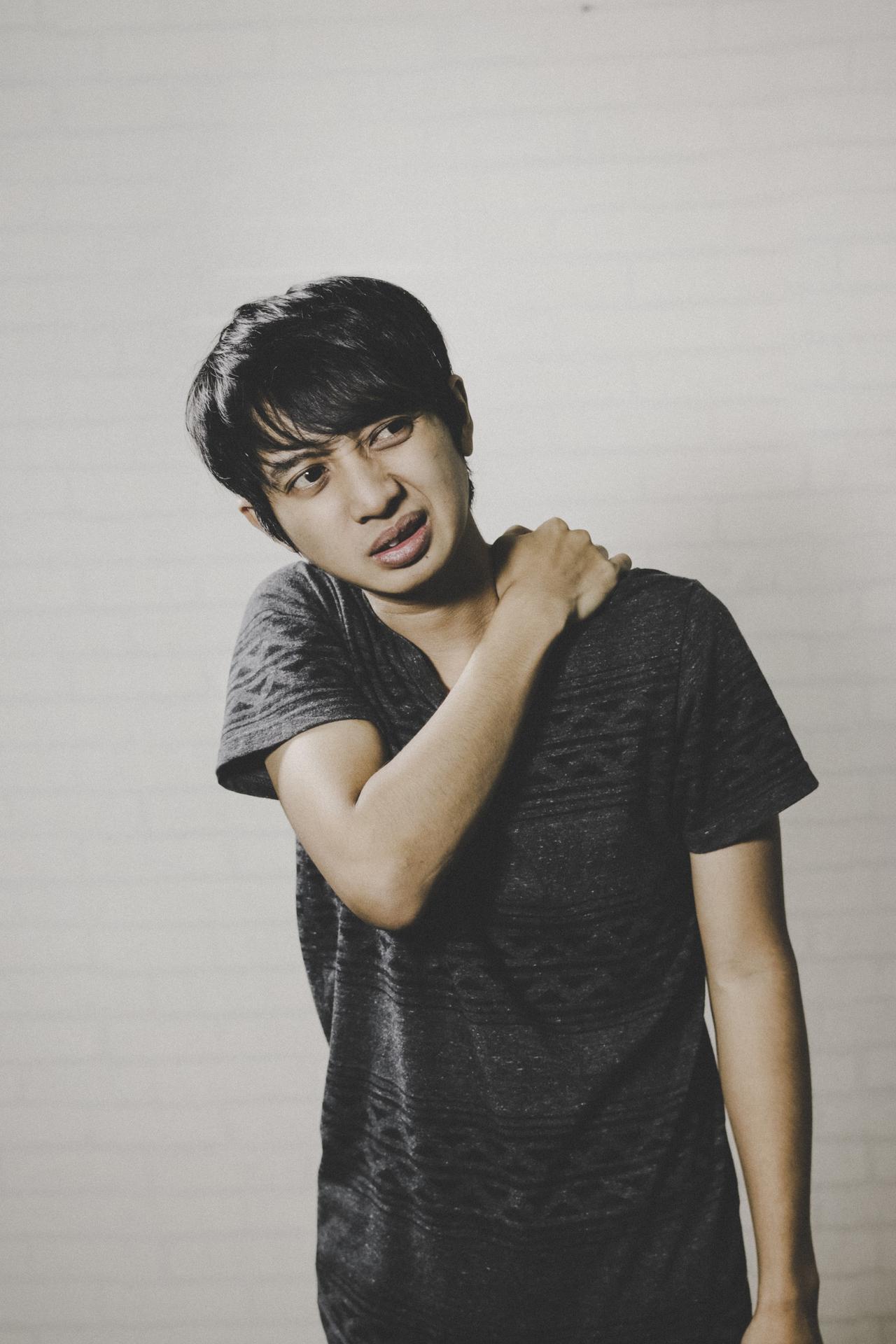

Accidents happen on the job. It doesn’t matter if you work in a trade or in an office, employees can get hurt for a variety of reasons. Fortunately for employees, they’re covered by the Workers’ Compensation Fund. Unfortunately for employers, you’re the one who fits the bill for this fund. Because there’s no out-of-pocket cost for employees as well as potential financial benefits, there can be fraud involved. At Samuel Hale, we want to help you stay informed on the ins and outs of workers’ comp, so we have a list of five things that you might not know about workers’ comp claims in California.

1. Pre-existing conditions made worse by work are covered

Unlike many insurance plans, a pre-existing condition that’s exacerbated on the job is going to be covered by workers’ comp. This can be anything from back pain to chronic headaches to arthritis or tendonitis. This includes more than just injuries. Diseases that are made worse on the job are covered as well.

Although, not all injuries that have to do with your company will be covered. Injuries that happen due to negligence or unsafe practices will not qualify. An employee who sprains an ankle at a company activity or during a lunch break might not be covered either.

2. Benefits can’t stop without notice

If you have employees who are receiving health or financial benefits from workers’ comp, these cannot be stopped without notice. An approved claim must continue to pay benefits even after an employee returns to work if there has not been a Notice of Modification/Suspension.

3. Workers’ comp is mandatory with even one part-time employee

As an employer, you’re required to carry workers’ comp coverage for your employees. A company that has even one part-time employee meets this requirement. While you might have an employee insurance policy, Workers’ Comp must be carried in order to provide benefits for any employees who are injured on the job.

You can also read: 3 Tips To Improve Your Current California Staffing Solution

4. Employers pay regardless of employee fault

Workers’ comp in the state of California is a no-fault program. This means that whether an employee is responsible for the injury or not, you pay for their coverage and benefits. Benefits can include something as small as a doctor visit and a prescription for pain medication up to long-term financial assistance and medical care. As a result, there is a certain amount of fraud that does occur.

5. Estimated 10% to 30% of workers’ comp claims in California are fraudulent

Most of your workers’ comp claims will be legitimate. Your employees will understand that the benefits they receive will pale in comparison to their everyday compensation. The financial payouts of a Workers’ Comp claim are only a percentage of what an employee brings in each payday.

However, approximately 10% to 30% of cases the state of California sees each year turn out to be fraudulent. A fraudulent claim can be either an employee lying about an injury or illness or an employer misclassifies an employee to avoid paying out benefits.

Get help with workers’ compensation from Samuel Hale

The team at Samuel Hale can help you avoid the broken workers’ comp system in California. Our team offers solutions to save you from fraud, litigation, and the confinements of the system. Give our team a call today at 855-726-4253 or send us a message using our email to find out how we’re saving businesses 80% in their workers’ comp claims in California.